Tilapia market

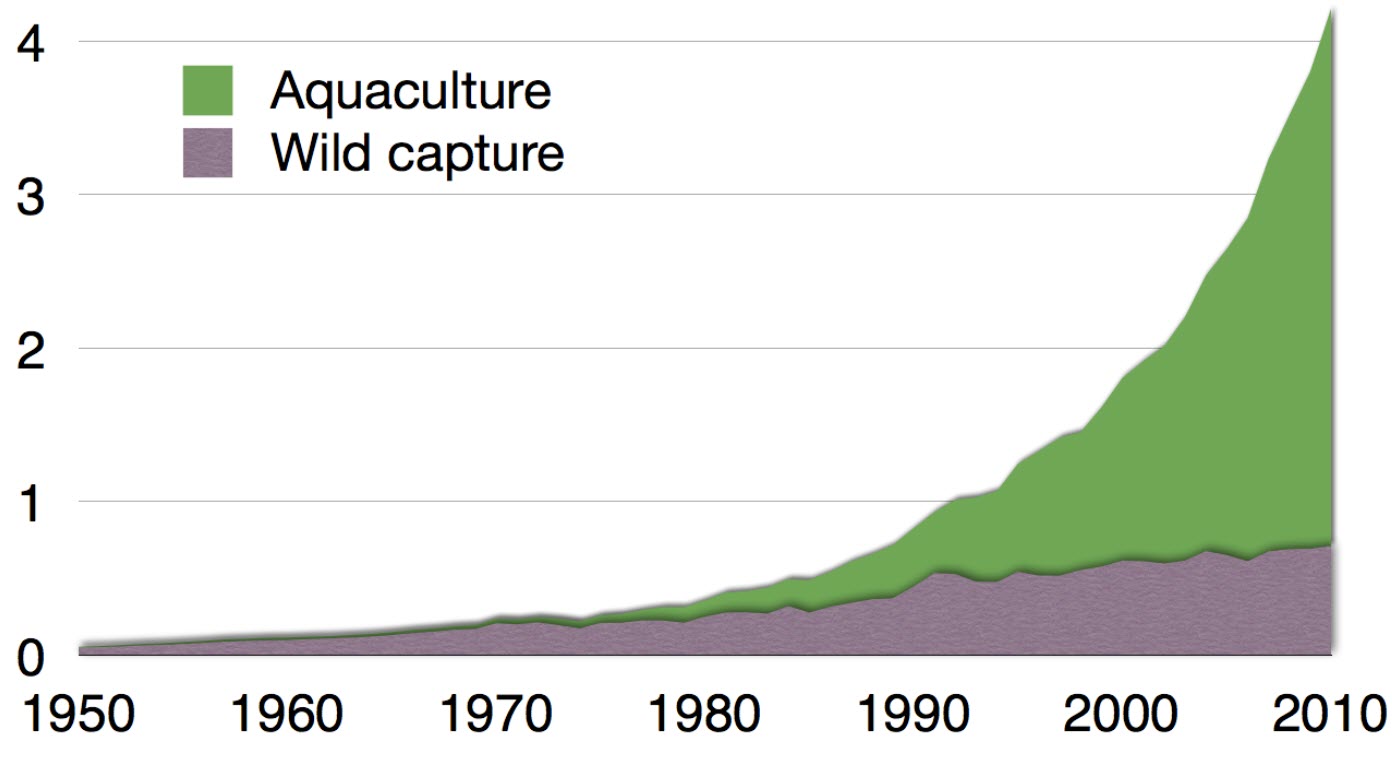

According to predictions made in 2007, the annual world-wide tilapia production will exceed that of salmon within a few years as it reaches 4 million tonnes per annum.

Who buys tilapia?

Only about one tenth of all farmed tilapia enters the global fish market; the remaining nine tenths are consumed domestically. Despite having a substantial domestic production of tilapia, the United States is by far the largest importer of tilapia since domestic production is much too low to satisfy consumer demands. Tilapia is not a popular food fish in Europe and the European Union imports no more than about 15,000 tonnes of tilapia per year. In the U.S., tilapia has become the fifth most popular seafood and the demand for frozen fillets is increasing rapidly. Between 2003 and 2006, the annual consumption of tilapia increased from a mere ¼ lbs per person and year to 1 lbs. This is a 300% increase in just three years!

According to a report from Globefish (http://www.globefish.org), an estimated 170,000 tonnes of tilapia were imported to the United States in 2007. With a conversation factor of roughly 2.85 for tilapia fillets, this equals approximately 400,000 tonnes of produced tilapia. The domestic production of tilapia was slightly above 9,000 tonnes in 2007 and a vast majority of these fishes were sold fresh, not frozen. The main purchasers were restaurants serving tilapia and vendors who sell the fish on Asian markets within the U.S.

The main reasons behind the augmented U.S. interest in tilapia is believed to be increased awareness of the health benefits associated with a diet rich in fish combined with consumer concerns about high levels of mercury in wild-caught fish. According to the guidelines offered to pregnant women by the US Department of Health, it is safe for a pregnant woman and her foetus to eat a 6 ounce serving of tilapia up to five times per week. When the U.S. Food and Drug Administration prohibited the import of various types of farmed seafood from China in 2007, they decided not to include tilapia on the list.

In the United States, the demand for whole frozen tilapia has gone down as the interest in frozen fillets, which are faster and easier to prepare, has skyrocketed. Frozen fish fillets from China now constitute a majority of all fish imported to the country. Uncertainties regarding the safety of water used by Chinese fish farms have however made certain consumer groups turn their eyes toward other tilapia producers, such as the ones located within the United States and in nearby Central America.

Tilapia farms in the U.S. and Latin America tend to produce fish for the fresh tilapia market to avoid having to compete with cheap frozen fillets shipped from China. The primary producers of fresh tilapia for the U.S. market are Honduras, Costa Rica and Ecuador; countries which all enjoy a tropical climate and can export tilapia year round.

On the U.S. tilapia market, you should expect to pay at least 5 USD / lbs for imported fresh fillets while fresh fillets from domestic aquacultures cost from 8-10 USD / lbs. Frozen tilapia fillets from China will on the other hand usually cost no more than 2 USD / lbs in grocery stores. During the early 1990s the price of frozen tilapia declined continuously but this downward movement now seems to have bottomed out and the price even increased somewhat in 2007, chiefly due to increased costs for tilapia fodder and a shortage of other similar types of fish.

Who produces tilapia?

Tilapia is a globally important commodity that is traded on commodity exchanges. There are also Tilapia futures that allows producers and buyers to protect themselves from price changes. These futures can also be used to speculate on the future market price of Tilapia. Numerous retail brokers allow you to trade with tilapia futures. The global market price for tilapia is very important for some of the main producers.

The largest exporter of tilapia is China, who exported a whopping 108,000 tonnes during the first 11 months of 2007 according to a report from Globefish (http://www.globefish.org). Compared to the first 11 months of 2006, this was an increase with almost 20 percent and the export of frozen tilapia fillets grew by over 40 percent during that same period. As mentioned above, U.S. consumers are increasingly switching over from whole tilapia to fillets; a movement which greatly affects the market.

The other main producers of frozen tilapia for the global fish market are Indonesia, the Philippines, Taiwan, and Thailand. This list may however change soon, as both Iran and India have decided to allow large-scale tilapia farming for the export market.

When it comes to fresh tilapia, countries located close to the vast U.S. market are at an advantage to their Asian competitors and a majority of the fresh tilapia sold in the U.S. hail from South- or Central America, with the main exporters being Honduras, Costa Rica and Ecuador. Brazil produces a lot of tilapia, but the large domestic market swallows most of the fish and only a small amount is exported. In 2005 and 2006, Costa Rican export of tilapia decreased sharply due to an outbreak of epidemic disease that killed massive amounts of farmed fish, but the export is now on the increase again.

Farminig vs. wild caught

A vast majority of the tilapia we consume each year are farmed raised tilapia from aquacultures. Tilapia can be caught from the wild as well, but farming is usually more beneficial financially and many consumers prefer farmed tilapia since it has a more uniform taste. Farmed tilapias also come in strains that can not be found in the wild, such as the attractively coloured red tilapias. For local markets, wild caught tilapia can however still be of major importance. A lot of people in Africa and the Middle East do for instance regularly eat wild-caught tilapia; either caught by themselves or purchased from fishermen on local fish markets.